Dubai has become a hotbed of investment from all corners of the globe. The handy location helps bridge the gap between East and West and provides a range of functions for tourists. Since the boom in 1966 following the creation of the Riyal currency with the newly independent state of Qatar before the switch to the Dubai dirham in 1973, Dubai has become a magnet for foreign and domestic investment. But, what does the investment landscape currently look like in Dubai, and where should investors begin to look when it comes to boosting their portfolios?

Source: Pixabay

Switching from Residential Investment to Derivatives

One of the main opportunities for investment is based around the tourist economy, so this would fall on residential and tourist properties. However, residential prices have begun to decline due to the supply glut, so it would make sense to look elsewhere for opportunities, such as investing in companies.

February 2019 saw Nasdaq Dubai launch futures trading on FTSE Russell's Saudi Arabia index of 46 listed companies. With options available within and outside of Dubai thanks to online trading platforms, investing in companies is a more viable option than it's ever been. Investing overseas on large FTSE 250 companies means that you could help aid their expansion, which could, in turn, lead to growth for Dubai. When it comes to CFD trading in Dubai, the emirate allows for trades on FTSE 250 companies, which ensure they are regulated and that your money is protected. This can be especially useful when seeing how companies may be affected by other economic issues across the globe. Modern investment methods mean that information can be analyzed and provide a wider picture based on global changes.

Strength of Stock Market Investment

The Dubai stock market also has opportunities for investment, including The Dubai Financial Market (DFM), which was established in 2000 and is regulated by the Securities and Commodities Authority under the Minister of Economy. This strong regulation means that it is a viable and solid investment platform and can be trusted. As Dubai presents itself as a greater investment for foreign investment, major companies may be looking at investing or merging with companies from Dubai, which could enhance your investment position.

Source: IG Source: IG

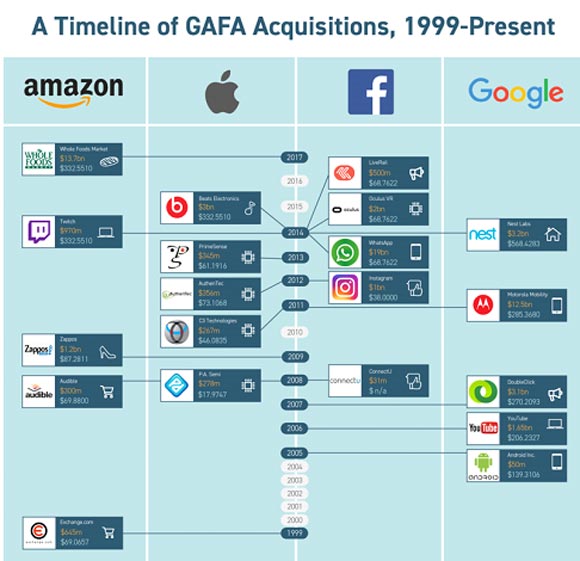

Indeed, taking a look at some of the major companies across the world that acquired other companies to create vast empires in various fields shows what a strong business model it is. Google, Amazon, Facebook and Apple own 20 other companies between them. So, if one sector of the corporation suffers, the complementary sector may be doing well enough to keep the company as a whole afloat until the difficult time is weathered. The stock market and derivatives are good investments over property right now as the property market is dependent on the industry being successful, while the stock market presents many different industries, each in different stages of being profitable.

There are plenty of opportunities for investment in Dubai – and unlike back in the 1960s, these don't have to be isolated from investment in conjunction with the rest of the world. The globalization means that investment can work in tandem with companies floated on various exchanges, as well as in other markets more local to particular regions such as property in Dubai.

|